Canvaloop, a new startup featured on Shark Tank Season 3, aimed to raise Rs 1 crore for 1.33% equity of the company. However, after impressing all five investors with their idea, they managed to secure Rs 2 crore for 4% equity of the Company.

Here is the complete market analysis of Canvaloop and its financial performance, investment specifics, and future goals.

Canvaloop Start-up’s Overview:

Canvaloop is a Surat-based startup that has developed proprietary technology to create sustainable textile fibres from agricultural waste. The company was founded by Shreyans Kokra.

They are a bio-material science company that converts agricultural waste into textile fibres and yarns using a zero-waste proprietary technology.

The company sells fibres and yarns, and not the final products.

Competitors as of 2024:

- GenCrest AgroFiber (Mumbai, India)

- Circular Systems AgroLoop BioFiber (USA)

Canvaloop’s Product Details:

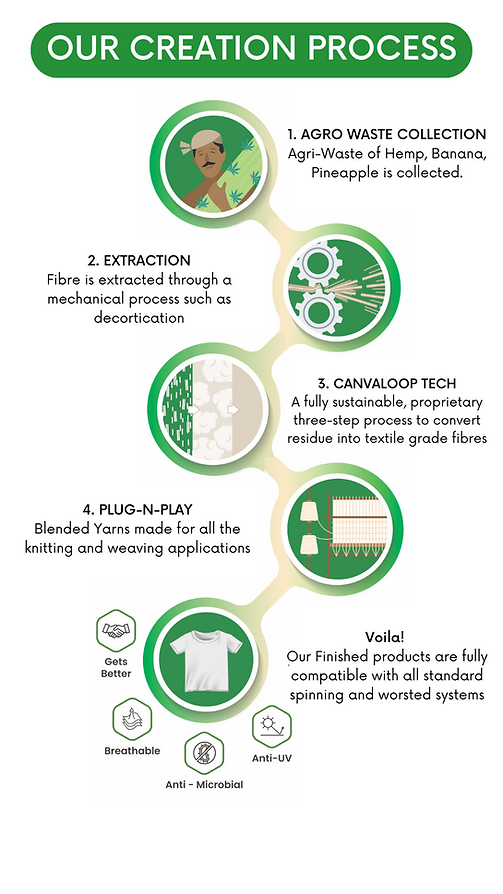

Canvaloop uses agricultural waste to produce fibres and yarn that can be used to make all major types of cotton and silk apparel.

The company’s proprietary technology allows them to create fibres from plant waste materials like hemp, banana, and oil seed stems.

The fibres produced have unique properties. The clothes produced are ethical, sustainable, and:

- Anti-UV

- Anti-microbial

- More Breathable, and

- Adaptable to weather conditions

Global brands like Levis (International), have also launched their products with fibre sourced from Canvaloop.

They manufacture two types of yarns or fibre:

- All-purpose Fibre: This can be used to manufacture shirts, carpets, blazers, sarees, etc. It has a feel somewhere between cotton and linen and is produced from the stem portion of Hemploop, banana loop, flax loop, etc.

- Silk Replacement Fibre: This fibre is a proper silk replacement and uses Pineapple leaves as raw material.

Price Comparison from Traditional Fibre

Traditional Cotton: Rs. 180-200 per Kg

Canvaloop Cotton: Rs. 350 per Kg

Raw Silk: Rs. 5500 per Kg

Canvaloop Silk: Rs. 2500 per Kg

The impact of these product details is significant as it positions Canvaloop as a pioneer in sustainable textile production. Their innovative use of agricultural waste not only addresses environmental concerns but also adds value by creating functionally superior products.

Source of this Information: Shark Tank India Season 3, Episode 52.

Production Process:

Canvaloop has 2 production lines and an installed capacity of 40 tonnes of Agri-waste per month. Each production line can roughly consume 20 tonnes of agri-waste and costs around Rs. 65-75 Lakhs to set up.

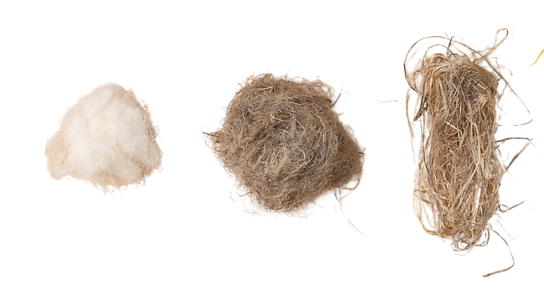

The process of converting Agri-waste into fibre begins at the farm. The farmers are provided with a crushing/separation machine. The farmers pass the agricultural waste through this machine and make blocks of agri-waste. This is then transported to Canvaloop’s factory.

Once the blocks reach the factory, it undergoes the following process:

- Biochemical Process/ Treatment Plant

The agri-waste has cellulose, lignin, pectin and other impurities bound by wax that need to be separated.

Through this biochemical process, the wax is dissolved and only cellulose and lignin remain in the fibre strand - Enzymatic Treatment

The treated fibre is then transferred to a tank that has active enzymes. These enzymes eat the surface and leave behind pure cellulose and lignin. - Long Mechanical Treatment

Through this process, the physical characteristics of the fibre are altered and made similar to that of cotton.

Energy Usage:

- Heating

The waste generated in the above process is converted into briquettes that are used as biofuels. - Water

Approximately 10L of water is used to produce 1 Kilogram of Fibre.

80% of this water is reused in the process and the rest 20% gets evaporated. - Electricity

They currently use electricity from the grid but can be switched to Solar when they have a larger production plant.

Raw Material Sourcing:

87 Metric tonnes of Agri-waste is burnt in India every year and the actual number may be much larger.

At the moment, Canvaloop imports 60% of their raw material and the rest 40% is sourced from farmer clusters from South Gujarat, Madhya Pradesh, Himachal Pradesh and Chattisgarh.

They plan to source 100% of their raw material from India within the next 3-5 years.

Canvaloop’s Market Analysis:

- The global hemp fibre market size is expected to grow to $36.21 billion in 2027.

- Canvaloop’s top competitors include Circular Systems and Kingdom Group.

- The impact of this market analysis is that it shows a huge potential for growth for Canvaloop.

- However, it also indicates that the company faces stiff competition and will need to continuously innovate to stay ahead.

Performance of Canvaloop in two Financial Years:

- The Start-up has shown impressive growth in sales, with sales figures:

FY 22-23: Rs 3.2 crore

FY 23-24 (till Feb) at Rs 7 crore (expected to close at 8 crores) - The company has secured a substantial purchase order of Rs 18 crore for FY 24-25.

- The impact of this financial performance is that it demonstrates Canvaloop’s strong market presence and potential for future growth. It also indicates the company’s ability to attract large orders, which is a positive sign for investors.

Information Source: Canvaloop’s Shark Tank Season 3 Episode (Episode link below)

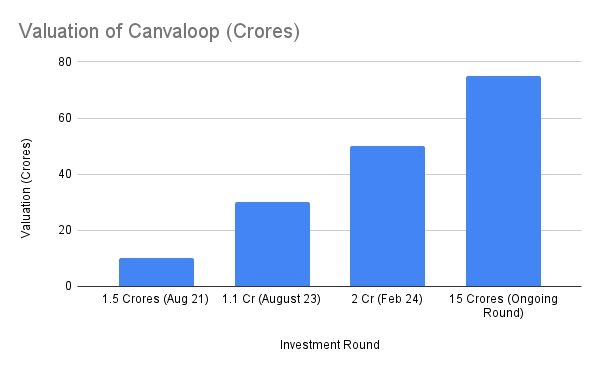

Overall Investment Details of Canvaloop:

Canvaloop has gone through several rounds of funding, with details below.

- In the first Pre-Seed round, Canvaloop raised 1.5 Crores at a 10 Crore (Pre-money) valuation which was led by Kia Ventures and Tata Social Alpha.

- In their bridge round in August 2023, they raised 1.1 Crores at 25 Crore (Floor) and 30 Crore (Cap) from their existing investors to get their certifications and as proof for their claims.

- As of March 2024, they were in the process of raising 15 Crores at a 75 Crore Valuation and wanted the sharks to participate in this ongoing round.

- All the sharks wanted a piece of the pie, and all five sharks gave a combined offer of an investment of Rs 2 crore for 4% equity in the Shark Tank India Episode which values the company at 50 Crores.

- The impact of these investment details is that they show investor confidence in Canvaloop’s business model and future prospects. It also provides the company with the necessary capital to expand its operations and reach.

Utilization Of Funds:

Shreayns Kokra, the co-founder, also talked about how the company plans to utilize the 15 Crore they are raising:

- Approx 9 Crore as Capital Expenditure to increase their current production from 40 Tonne a month to 300 Tonne a month.

- For Research and Development to make the fibre softer so that it can be used for innerwear clothing.

- Marketing

We feel that they should not invest to make their fibre softer and instead focus more on replacing silk. The silk made from their process is environment friendly, anti-UV, anti-microbial, more breathable and at the same time cheaper than traditional silk.

We feel they should double down on producing silk which has a better chance of being accepted in the market.

Impact Analysis:

- Canvaloop’s production process uses

1. 99% less water than traditional polyester.

2. Emits 87% less carbon, and

3. Utilizes 82% less energy than traditional fibre production - The impact of this is huge as it positions Canvaloop as a leader in sustainable textile production. This not only helps the environment but also appeals to consumers who are increasingly looking for eco-friendly products.

Future Plans:

- Canvaloop plans to promote sustainability in the textile industry by providing high-quality fibres made from agricultural waste.

- The impact of these future plans is that they show Canvaloop’s commitment to sustainability and its ambition to lead the way in eco-friendly textile production.

SWOT Analysis for Canvaloop Startup as of 2024

- Strengths: Proprietary technology, sustainable and superior products, strong financial performance, and investor confidence.

- Weaknesses: A relatively new company with limited track record, and potential supply chain issues due to reliance on agricultural waste.

- Opportunities: Growing demand for sustainable fabrics, the potential to expand product range and enter new markets.

- Threats: Competition from other companies in the sustainable textile industry, and potential regulatory changes affecting the use of agricultural waste.

The impact of this SWOT analysis is that it provides a comprehensive overview of Canvaloop’s current position and potential future trajectory.

Read More at:

Conclusion on Canvaloop Start-ups:

This article highlights the areas where the company excels and areas where there may be room for improvement. It also identifies opportunities for growth and potential threats that need to be managed.

Please note that some of the information needed for a more detailed analysis, such as strategic partnerships, was not readily available. For a more comprehensive analysis, additional information would be needed.