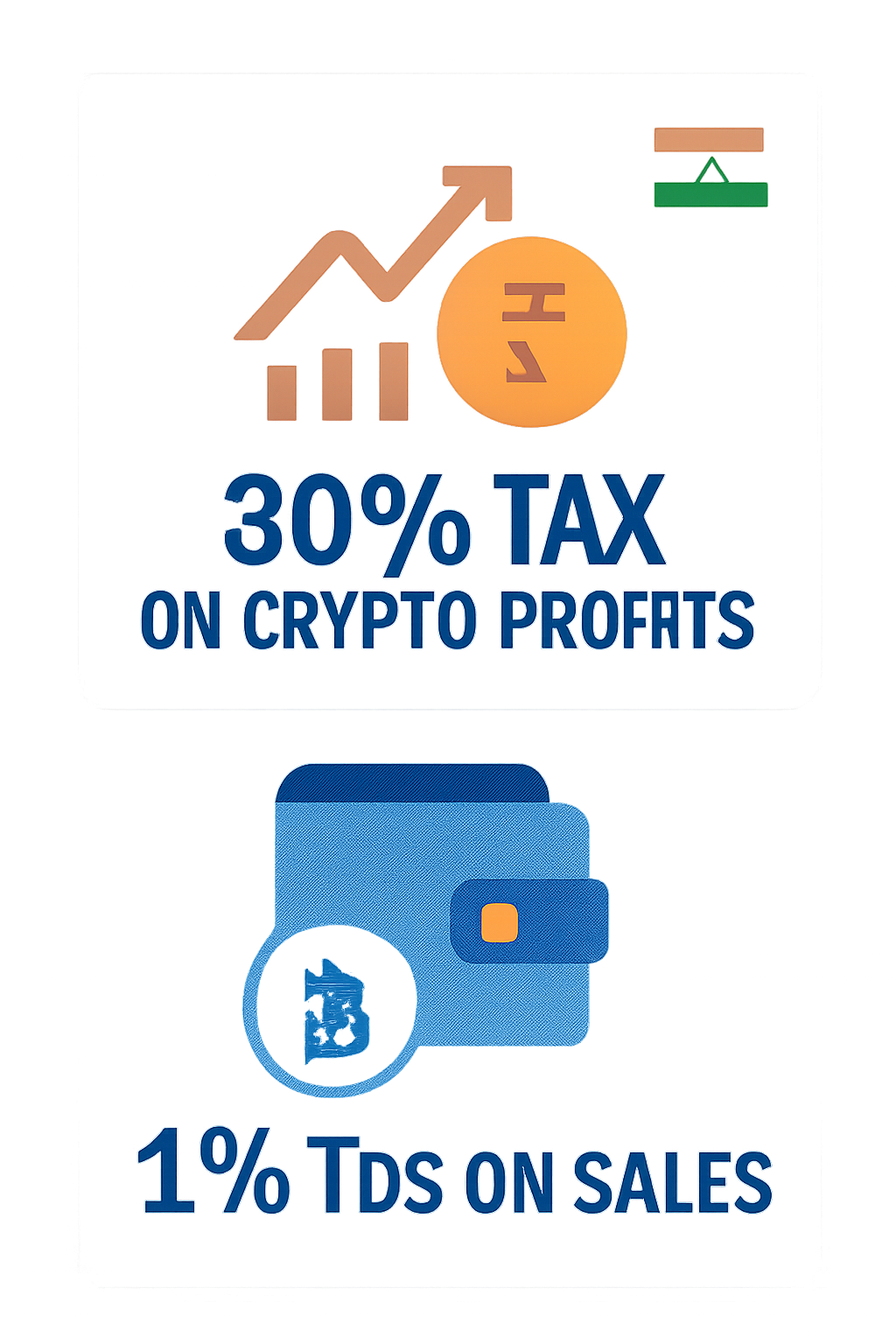

There is no blanket crypto ban in India as of 2025. Trading and holding cryptocurrencies are legal, but tightly regulated. Profits from virtual digital assets (VDAs) are taxed at 30%, and a 1% TDS applies to most sales transactions. Cryptocurrency exchanges and service providers must register with the FIU-IND and comply with PMLA AML/KYC rules to operate legally.

The 2018 RBI banking ban that restricted banks from dealing with crypto was overturned by the Supreme Court in 2020, allowing exchanges to resume operations. India’s current approach focuses on risk-based regulation, taxation, and compliance, rather than prohibition, while draft bills and periodic enforcement actions often generate confusion around a supposed crypto ban in India.

Table of Contents

Why do people still search for Crypto Ban India?

Many people continue searching for “Crypto Ban India” due to confusion caused by headlines, draft bills, and enforcement actions. Over the years, the Indian government has proposed multiple bills aimed at regulating or restricting private cryptocurrencies, such as the 2019 draft and the 2021 Cryptocurrency and Regulation of Official Digital Currency Bill.

Although none were passed into law, media coverage often framed them as a potential ban. Additionally, regulatory enforcement actions—like fines, temporary access blocks, or scrutiny of exchanges such as Binance and WazirX—are sometimes misinterpreted as a prohibition. Combined with ongoing debates about taxation, AML/KYC compliance, and the rise of digital assets, this mix of proposals, enforcement, and media reporting keeps public interest and searches around a “crypto ban” high.

Crypto Ban India | Latest News 2025

- No blanket crypto ban in India: The government has not prohibited trading or holding cryptocurrencies.

- Regulation and taxation rules: India emphasizes compliance over prohibition, focusing on risk-based regulation.

- FIU-IND registration & AML/KYC compliance: All Virtual Digital Asset (VDA) service providers and exchanges must register with FIU-IND.

- Must comply with PMLA AML/KYC regulations to operate legally.

Taxation rules on Crypto in India

- 30% tax on profits from VDAs.

- 1% TDS on most sales transactions.

Offshore platforms enforcement (2023–2024):

- Non-compliant exchanges faced fines and temporary access blocks.

Domestic exchanges:

Platforms like WazirX continue operating under regulation, following FIU registration and AML compliance.

Public confusion: Draft bills and media coverage often misrepresent regulation as a “crypto ban.”

Is crypto banned in India?

No. The Supreme Court (2020) set aside the RBI’s 2018 banking curb. Since 2022, the government has taken a “regulate and tax” approach (30% tax + 1% TDS).

Crypto isn’t legal tender, but trading/holding is permitted subject to tax and AML compliance.

Crypto Ban India Bill: What those bills actually mean

2019 Draft Bill:

- Proposed to prohibit private cryptocurrencies while exploring a central bank digital currency (CBDC / Digital Rupee).

- Created initial confusion over whether trading would be banned.

2021 Bill (“Cryptocurrency and Regulation of Official Digital Currency Bill”):

- Listed but never tabled into law.

- Sought to regulate private cryptocurrencies and authorize an official digital currency.

- Media coverage often portrayed it as a potential ban.

2022–2025 Policy Shift:

- No bill banning crypto passed.

- Government focuses on risk-based regulation, taxation (30% profit tax + 1% TDS), and AML/KYC compliance.

- Draft bills now mainly provide context for compliance rather than enforce prohibition.

Keyword note: When you see “private crypto ban India,” it refers to proposals to restrict non-sovereign crypto, not a law in force.

Taxes & Compliance: What actually applies to Crypto in India

Taxes on Crypto

- 30% Tax on Profits: Profits from trading or selling Virtual Digital Assets (VDAs) are taxed at 30% under the Income Tax Act.

- 1% TDS on Sales: Most VDA sell transactions are subject to 1% TDS, effective from July 1, 2022.

- No Loss Set-Off: Losses from crypto transactions cannot be set off against other income or carried forward.

AML/KYC Compliance

- FIU-IND Registration: All VDA service providers and exchanges must register with the Financial Intelligence Unit – India.

- PMLA Obligations: Providers must maintain KYC records, monitor transactions, and file Suspicious Transaction Reports (STRs).

- Non-Compliance Consequences: Penalties, fines, or temporary access blocks may be imposed on non-compliant platforms (e.g., Binance, Bybit).

Key Takeaway

- India emphasizes regulating and taxing, not prohibiting. Compliance with tax and AML/KYC rules is mandatory for legal operation.

Crypto Ban India List: Key Events & Actions (2018–2025)

2018 RBI Banking on Crypto:

- The Reserve Bank of India asked banks to stop dealing with cryptocurrency exchanges, effectively restricting fiat-crypto operations.

March 2020

- Supreme Court Overturns RBI Ban: The 2018 banking restriction was quashed, allowing banks to resume crypto services.

Budget 2022: Tax & TDS Introduced:

- 30% tax on profits from Virtual Digital Assets (VDAs)

- 1% TDS on most sales transactions

March 2023

- PMLA Extended to VDAs: FIU-IND registration made mandatory; KYC/AML compliance enforced.

December 2023

- Offshore Exchange Crackdown: Notices issued; MeitY instructed to block non-compliant platforms.

2024–2025

- Compliance & Fines: Offshore platforms began registering, fines and penalties were issued compliance operations resumed.

- Domestic exchanges like WazirX continued under regulation.

Crypto Ban India WazirX: What to know

- WazirX faced ED probes in 2022, and bank accounts were unfrozen later in 2022 while investigations continued.

- Government responses in 2023 indicated WazirX among FIU-registered VDA-SPs.

- In 2024–2025, industry scrutiny remained high after WazirX’s widely reported cyberattack (2024) and ongoing court processes around recovery.

How India handles Ban vs Regulate of Crypto -Policy Lens

The Reserve Bank of India (RBI) warns of financial stability risks posed by cryptocurrencies, including volatility, fraud, and money laundering.

RBI’s Stance on Crypto: Cautious Regulation

RBI does not support private crypto as legal tender, but allows trading on regulated exchanges.

Government’s Stance: Regulate, Not Ban on Crypto

India has shifted from proposed bans to a risk-based regulatory approach. Focus is on:

- Taxation: 30% tax on profits, 1% TDS on sales

- AML/KYC compliance: FIU-IND registration for exchanges

- CBDC exploration: Development of Digital Rupee (e₹)

- Collaboration with global regulators to align crypto oversight.

Practical Policy Lens on Crypto

- Enforcement targets non-compliant exchanges rather than banning crypto.

- Draft bills are mainly frameworks for regulation, not prohibition.

- India’s model: “Regulate, Tax, and Monitor” over outright bans.

Practical Guide for Crypto Users in India

If you trade/hold crypto in India. Here’s a Practical Guide for Users on Crypto in India (2025) in a clear, actionable format:

- Use FIU-registered platforms (check FIU lists/official responses).

- Complete KYC and enable 2FA.

- Track taxes (30% on gains; 1% TDS). Keep meticulous records.

- Avoid non-compliant offshore apps—they can face blocks or penalties.

- Stay updated with enforcement/news before large transfers (penalties or access blocks can affect withdrawals).

Follow news and official announcements on Crypto regulations and latest government guidelines to stay safe.

Final Words on Crypto Ban in India:

The reality in 2025 is regulation, not prohibition, like taxes, TDS, and strict AML compliance, plus periodic enforcement that can restrict non-compliant platforms.

Stay on FIU-registered exchanges, keep tax records, and track regulatory updates to minimize risk.

Read More at:

- Crypto Batter Legal or Not | KYC Rules for SIM | TRAI SIM Registration

- Crypto Batter | Secure SIM, Fast Data & Full Ownership Tracking | 2025

- The Coin Republic Crypto Analysis: Unveiling Market Trends & Insights | 2025

FAQs on Crypto Ban in India

Is crypto banned in India right now?

No. Trading/holding is allowed with 30% tax, 1% TDS, and AML/KYC rules.

What is the latest crypto ban in India news?

Recent actions target non-compliant exchanges (fines/blocks). The policy remains regulated, not banned.

What does “private crypto ban in India” mean?

Draft bills floated restricting private cryptocurrencies; no such blanket ban has been enacted.

What is the crypto ban in India bill?

2019/2021 proposals were not passed; India shifted to taxation + AML oversight.

Is WazirX banned?

No blanket ban on WazirX; it faced probes, accounts were unfrozen (2022), compliance and court matters continue.